Swift and accurate cash application leads to better straight-through processing rates, lower processing costs, reduced DSO, improved efficiencies, and better customer service.

When automating cash application, ROI is critical.

In this TEI™ commissioned study conducted by Forrester Consulting for Versapay (May 2024), you'll learn how a composite organization of customers achieved significant ROI.

That includes:

For accounts receivable (AR), there's no more important process. But exactly what is the cash application process in AR? It's quite literally what it sounds like: When payment from a customer arrives, it needs to be applied to the right open invoices and accounts.

The process of cash application is crucial for managing AR, yet manually reconciling payments with invoices is time-consuming and error-prone—but the process is essential to efficient working capital and resource utilization.

The arrival of digital payments might have been expected to streamline this process but, ironically, it further complicated it. Electronic payments are often sent without remittance slips, making it tougher for cash application specialists to identify which invoice is being paid—and potentially creating friction between buyers and sellers.

Swift and accurate cash application leads to better straight-through processing rates, lower processing costs, reduced days sales outstanding (DSO), improved efficiencies, and better customer service. By utilizing powerful tools such as AI and machine learning, you can optimize your AR team’s cash application process, resulting in faster, more accurate, and more efficient processes.

This can lead to improved cash flow, a better bottom line, greater employee productivity, and better customer experiences, all of which can help your business meet operational expenses, reinvest in the business, and fund expansion plans.

Invoice-to-cash (I2C) refers to the process that runs from the moment an invoice is created until the customer's debt is settled via payment. Cash application is a critical step in the I2C process. By following clear procedures for payment matching and reconciliation, handling exceptions and disputes, and applying cash efficiently, businesses optimize the cash application process in AR and improve overall cash flow.

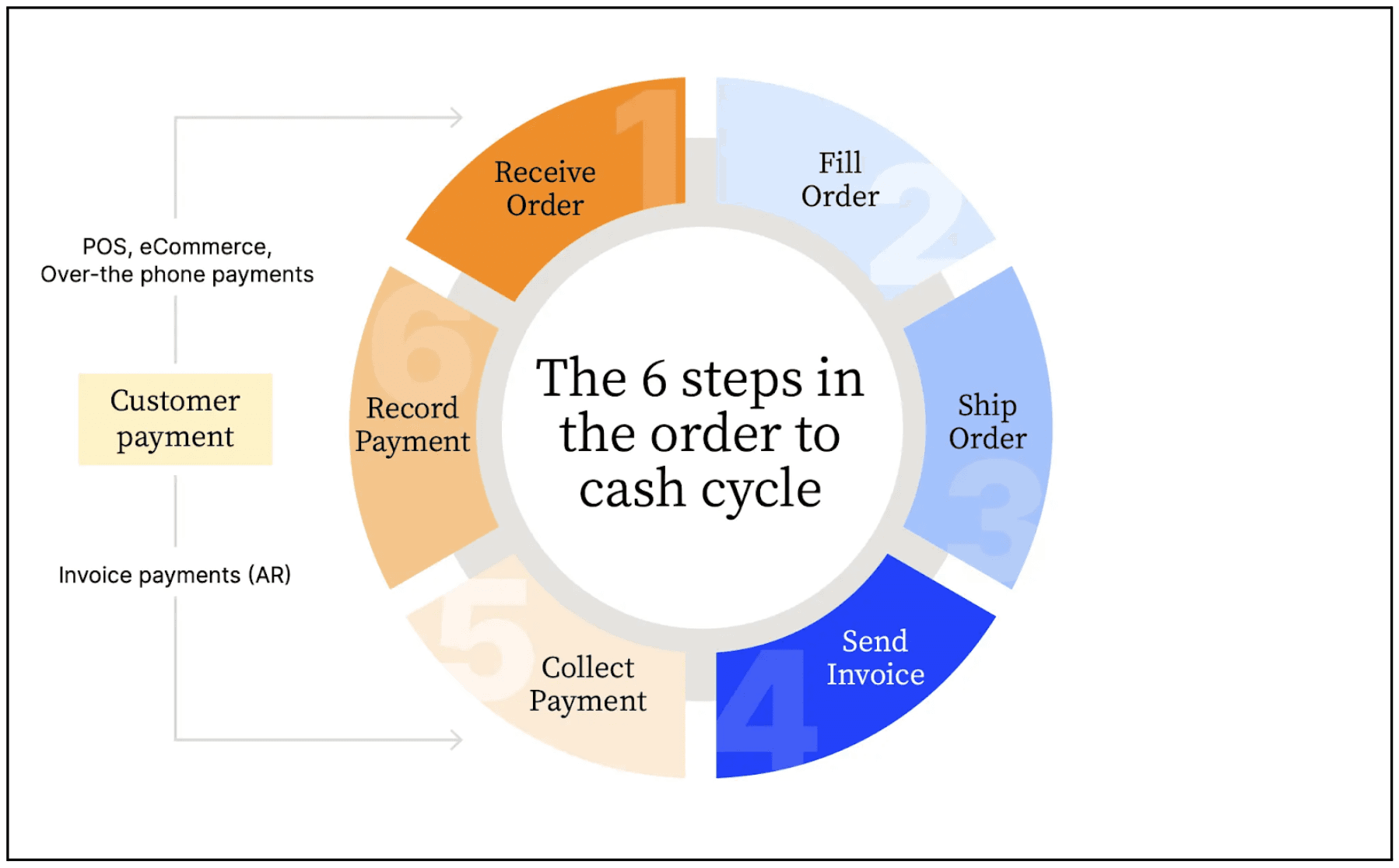

To add complexity (and confusion) I2C is a subset of the order-to-cash process that encompasses the entire sales cycle, from quote generation to payment receipt and closing of a sale.

So, where does cash application fit into all this? At the nine o’clock spot in the illustration below — O2C Step 6: Record Payment.

Back to our first question: What is cash application? It’s a critical link in the O2C cycle, along with proper invoicing and collections. Without it, you won't generate or identify revenue or profit, nor will you be able to allocate your earnings towards other aspects of the business. Plus, building a more streamlined O2C cycle provides a winning experience to your customers that’s essential for repeat business or referrals.

Although companies vary in nature, size, volume of customers, quantity of invoices, and delivery and payment methods, most follow similar general steps in their cash application process:

Here are the most common and useful terms to understand when discussing cash application and the various facets of the process.