- If the current LIBOR is greater than the FRA rate, the long can effectively borrow at a below-market rate. The long receives a payment based on the difference between the two rates.

- However, if the current LIBOR was lower than the FRA rate, then long makes a payment to the short. The payment ends up compensating for any change in interest rates since the contract date

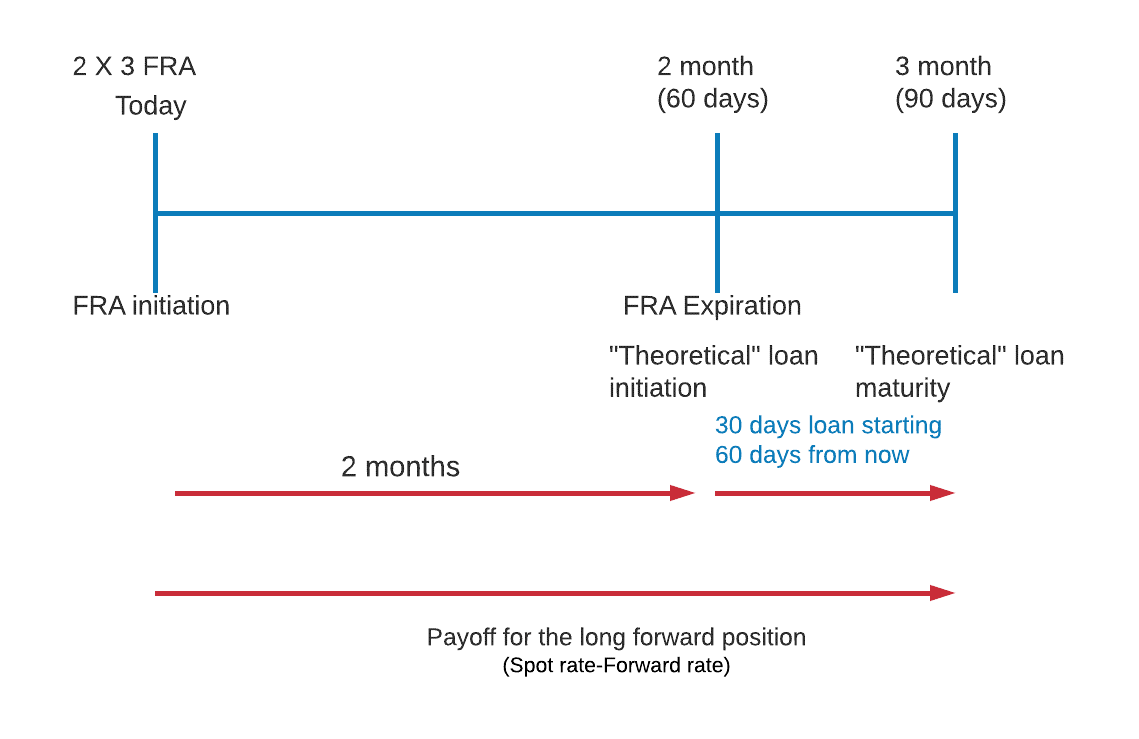

Illustration

Example 2: FRA Valuation

Suppose we have a 1 x 4 FRA with a notional principal of $1 million. At contract expiration, the 90-day LIBOR at settlement is 6% and the contract rate is 5.5%.

Calculate the value of the FRA at maturity.

Solution

Since the settlement rate is higher (6%) than the contract rate (5.5%), the buyer will be receiving money from the seller. The payment to the long at settlement are as follow:

Discounted back 90 days @ 6%:

Added to clipboard × Shop CFA® Exam PrepOffered by AnalystPrep

Level I

Level II

Level III

All Three Levels

FRM Part I

FRM Part II

FRM Part I & Part II

Exam P (Probability)

Exam FM (Financial Mathematics)

Exams P & FM

GMAT Focus

Executive Assessment

GRE

FRM Exam Preparation

Beta and CAPM

Related Posts Oct 08, 2019Equity Investment – CFA® Level I Es .

Reading 36 – Market Organization and Structure Financial markets serve a wide variety. Read More

career cfa study-tips Aug 13, 2021What is the Difference between the CFA .

Whether you are considering a career in finance or are a professional, you. Read More

career cfa study-tips Jun 23, 2021What are the Differences between CFA® .

One of the most common questions that CFA candidates have is the differences. Read More

career cfa study-tips Sep 05, 2022Changes to CFA level III: Effective Fe .

Just like every other year, CFA once again made changes to its curriculum. Read More

AnalystPrep

Study Tools

Useful Links

Languages

AnalystPrep © 2014-2021

All Rights Reserved

1751 Richardson Street, Montreal, QC H3K 1G5

support@analystprep.com

Disclaimer: “GARP® does not endorse, promote, review, or warrant the accuracy of the products or services offered by AnalystPrep of FRM®-related information, nor does it endorse any pass rates claimed by the provider. Further, GARP® is not responsible for any fees or costs paid by the user to AnalystPrep, nor is GARP® responsible for any fees or costs of any person or entity providing any services to AnalystPrep. FRM®, GARP®, and Global Association of Risk Professionals™ are trademarks owned by the Global Association of Risk Professionals, Inc.

CFA Institute does not endorse, promote or warrant the accuracy or quality of AnalystPrep. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.